John Melendez's net worth refers to the total value of his financial assets, including cash, investments, and properties. It represents an individual's financial well-being and is often used to gauge their economic status. For instance, a person with a net worth of several million dollars is considered wealthy, while someone with a negative net worth may be struggling financially.

Knowing an individual's net worth is important for various reasons. It can provide insights into their financial stability, investment savvy, and overall financial health. Additionally, it can be a factor in decision-making for potential investors or business partners. Historically, the concept of net worth has evolved over time, with the inclusion of intangible assets and the recognition of liabilities in modern calculations.

This article will delve into the details of John Melendez's net worth, examining its components, analyzing its growth trajectory, and exploring the factors that have contributed to its current value.

John Melendez S Net Worth

John Melendez's net worth, a measure of his financial standing, encompasses various key aspects that provide insights into his wealth and financial well-being. These aspects include:

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Cash flow

- Debt

- Equity

- Financial health

Understanding these aspects is crucial for evaluating Melendez's overall financial position. His assets, such as properties and investments, represent his ownership and value, while liabilities, such as mortgages or loans, indicate his financial obligations. Income and expenses provide insights into his cash flow, while debt and equity positions shed light on his leverage and risk profile. Ultimately, these aspects collectively paint a picture of Melendez's financial health and wealth management strategies.

Assets

Assets, a cornerstone of John Melendez's net worth, encompass all the valuable resources, properties, and economic resources he owns. These assets contribute significantly to his financial standing and overall wealth.

- Cash and Cash Equivalents

This includes physical cash on hand, demand deposits, and other liquid assets that can be easily converted into cash. Cash and cash equivalents provide immediate access to funds for various financial needs.

- Investments

Melendez's investments may include stocks, bonds, mutual funds, real estate, and other financial instruments. These investments represent ownership or a stake in various assets with the potential for growth and income generation.

- Property

Real estate holdings, such as residential properties, commercial buildings, or land, form a significant portion of Melendez's assets. Properties provide tangible assets with potential for appreciation, rental income, and tax benefits.

- Intellectual Property

Patents, trademarks, copyrights, and other forms of intellectual property represent intangible assets that can generate income through licensing, royalties, or direct sales. These assets stem from creative or inventive endeavors.

The composition and value of Melendez's assets play a crucial role in determining his overall net worth. A diversified portfolio of assets, including a mix of liquid, growth-oriented, and income-generating assets, contributes to a well-balanced and resilient financial position.

Liabilities

Liabilities, an essential component of John Melendez's net worth, represent financial obligations and debts that he owes to other entities or individuals. Understanding his liabilities provides insights into his financial leverage, risk profile, and overall financial health.

- Accounts Payable

These are short-term debts owed to suppliers or vendors for goods or services purchased on credit. Accounts payable are typically due within a specified period, such as 30 or 60 days.

- Loans

Loans represent borrowed funds from banks, financial institutions, or individuals. They can be secured by collateral, such as a mortgage on a property, or unsecured, relying on the borrower's creditworthiness.

- Taxes Payable

These are outstanding tax obligations to government entities, such as income tax, sales tax, or property tax. Tax liabilities must be settled within specified deadlines to avoid penalties or legal consequences.

- Deferred Revenue

Deferred revenue arises when a business receives payment for goods or services that have not yet been delivered or performed. It represents a liability until the goods or services are provided.

The presence and extent of liabilities influence Melendez's financial flexibility and ability to pursue new opportunities. High levels of debt, for example, can limit his access to additional financing and increase his vulnerability to economic downturns. Conversely, managing liabilities effectively can contribute to a stronger financial position and long-term financial success.

Investments

Investments are a vital component of John Melendez's net worth, representing assets that have the potential to grow in value over time. These investments contribute significantly to his overall financial well-being and play a crucial role in long-term wealth accumulation and financial security.

- Stocks

Stocks represent ownership in publicly traded companies. Melendez's stock portfolio may include shares in various industries, such as technology, healthcare, or consumer goods, providing diversification and potential for capital appreciation and dividends.

- Bonds

Bonds are fixed-income securities that represent loans made to governments or corporations. Melendez's bond investments provide regular interest payments and return of principal at maturity, offering a more conservative investment option with lower risk and potential returns than stocks.

- Real Estate

Real estate investments include properties such as residential homes, commercial buildings, or land. Melendez may own properties directly or through investment trusts, benefiting from potential rental income, property appreciation, and tax advantages.

- Alternative Investments

Alternative investments encompass a wide range of assets beyond traditional stocks and bonds, such as private equity, hedge funds, commodities, or collectibles. Melendez may allocate a portion of his portfolio to these investments to diversify his holdings and potentially enhance returns.

The composition and performance of Melendez's investment portfolio are key determinants of his net worth growth. A well-diversified portfolio, balanced across different asset classes and sectors, can mitigate risk and maximize potential returns. The success of his investments hinges on factors such as market conditions, economic trends, and the expertise of his investment managers.

Income

Income is a critical component of John Melendez's net worth, representing the inflow of funds that contribute to his financial well-being. Understanding the various sources and components of his income provides insights into the sustainability and growth potential of his net worth.

- Salary and Wages

Melendez may earn income through his employment, receiving regular payments for his work. Salary and wages represent a stable source of income and form the foundation of his financial security.

- Business Income

If Melendez owns a business, he may generate income through its operations. Business income includes profits, dividends, and distributions from his entrepreneurial endeavors.

- Investment Income

Melendez may earn income from his investments, such as interest payments from bonds, dividends from stocks, or rental income from real estate. Investment income provides passive income streams and contributes to the growth of his net worth.

- Other Income

This category encompasses various other sources of income, such as royalties, commissions, or income from intellectual property. These additional income streams can supplement Melendez's primary sources and contribute to his overall financial well-being.

The stability, diversity, and growth potential of these income streams are key factors in determining the trajectory of Melendez's net worth. A consistent and diversified income base provides a solid foundation for financial security and wealth accumulation, while high-growth income streams can significantly contribute to rapid net worth growth.

Expenses

Expenses represent a crucial aspect of John Melendez's net worth, as they impact the sustainability and growth trajectory of his overall financial standing. Understanding the types, implications, and management of expenses is essential for maintaining financial health and maximizing wealth accumulation.

- Fixed Expenses

Fixed expenses remain relatively constant from month to month, regardless of income fluctuations. These include essential expenses such as mortgage or rent payments, car payments, insurance premiums, and property taxes.

- Variable Expenses

Variable expenses fluctuate based on spending habits and consumption patterns. Examples include groceries, entertainment, dining out, and travel costs. Managing variable expenses effectively can lead to significant savings and contribute to net worth growth.

- Discretionary Expenses

Discretionary expenses encompass non-essential purchases and luxuries, such as designer clothes, expensive gadgets, or lavish vacations. While these expenses can enhance one's lifestyle, controlling and optimizing them can free up funds for savings, investments, and other wealth-building activities.

- Debt Repayments

Debt repayments, including principal and interest payments on loans and credit cards, directly impact Melendez's financial obligations and net worth. Higher debt repayments reduce disposable income and can hinder wealth accumulation, while managing debt effectively can improve financial flexibility and increase net worth over time.

By carefully monitoring and managing expenses, John Melendez can optimize his financial resources, minimize unnecessary outflows, and allocate more funds towards investments and wealth-building strategies. A comprehensive understanding of his expense structure and the effective implementation of cost-saving measures will be instrumental in maximizing his net worth and achieving long-term financial success.

Cash Flow

Cash flow plays a pivotal role in determining John Melendez's net worth, as it represents the movement of money in and out of his financial accounts. Positive cash flow, where more money flows in than out, contributes directly to the growth of his net worth. Conversely, negative cash flow, where expenses exceed income, can erode his net worth over time.

A key component of cash flow management is understanding the sources and uses of funds. Melendez's income from various sources, such as his salary, business ventures, and investments, contributes to his cash inflows. On the other hand, his expenses, including living costs, debt repayments, and taxes, represent cash outflows. By carefully monitoring and managing these cash flows, Melendez can ensure that his net worth remains positive and continues to grow.

Real-life examples of cash flow within John Melendez's net worth include the profits generated from his business ventures being reinvested into the business to expand operations and increase future income potential. Additionally, the rental income received from his real estate investments provides a steady stream of cash flow that can be used to cover expenses, pay down debt, or invest in new opportunities.

Understanding the connection between cash flow and John Melendez's net worth is crucial for making informed financial decisions. By focusing on increasing cash inflows, optimizing cash outflows, and managing cash flow effectively, Melendez can maximize his net worth and achieve long-term financial success. This understanding is essential for individuals and businesses alike, as it provides a framework for financial planning, risk management, and wealth creation.

Debt

Debt is a crucial aspect of John Melendez's net worth, representing his financial obligations and liabilities. Understanding the different types of debt, their implications, and how Melendez manages them is essential for assessing his financial health and overall net worth.

- Mortgages

Mortgages are loans secured by real estate, typically used to finance the purchase of a home. They represent a significant portion of debt for many individuals, including Melendez, and impact his net worth by reducing the equity he has in his property.

- Business Loans

Melendez may have acquired loans to finance his business ventures. These loans can provide the necessary capital for expansion, inventory, or other business needs. However, they also increase his debt burden and need to be carefully managed to avoid financial distress.

- Credit Card Debt

Credit card debt is a common form of unsecured debt that can accumulate quickly if not managed responsibly. High credit card balances can negatively impact Melendez's credit score and increase his monthly expenses, potentially hindering his ability to save and grow his net worth.

- Personal Loans

Personal loans can be used for various purposes, such as consolidating debt, financing education, or covering unexpected expenses. While they may offer lower interest rates than credit cards, personal loans still represent a debt obligation that Melendez must repay.

The presence and management of debt can significantly influence Melendez's financial flexibility, investment decisions, and overall net worth trajectory. High levels of debt can limit his ability to access additional financing, increase his risk exposure, and reduce his potential for wealth accumulation. Conversely, effectively managing debt, such as paying down balances strategically and maintaining a good credit score, can improve his financial well-being and contribute to long-term net worth growth.

Equity

Equity represents a crucial component of John Melendez's net worth, reflecting the value of his ownership interest in assets minus any liabilities or claims against those assets. Understanding the connection between equity and Melendez's net worth is essential for assessing his financial well-being and overall wealth.

A fundamental principle of net worth is that it increases as equity increases. This is because equity represents the portion of an asset's value that belongs to the owner, free and clear of any debt or other obligations. For instance, if Melendez owns a house worth $500,000 with a mortgage balance of $200,000, his equity in the house would be $300,000. This equity contributes directly to his net worth.

Managing equity effectively is vital for building and preserving wealth. By reducing debt and increasing the value of his assets, Melendez can grow his equity and, consequently, his net worth. Real-life examples within Melendez's net worth include his ownership of stocks and bonds, where the value of these investments directly impacts his equity. Additionally, any appreciation in the value of his real estate holdings would also contribute to equity growth.

Understanding the connection between equity and net worth empowers Melendez to make informed financial decisions. By prioritizing debt repayment, investing in appreciating assets, and managing his equity strategically, he can maximize his net worth and achieve long-term financial success. This understanding underscores the importance of asset accumulation, debt management, and financial planning for individuals seeking to build and preserve their wealth.

Financial health

Financial health holds a profound connection to John Melendez's net worth, acting as a cornerstone upon which his overall wealth is built. A sound financial health enables Melendez to make informed decisions, manage risks, and maximize opportunities that contribute to the growth of his net worth. Conversely, poor financial health can hinder wealth accumulation and erode his net worth over time.

The relationship between financial health and net worth is multifaceted. Financial health encompasses factors such as income stability, debt management, savings habits, and investment strategies. Each of these factors directly influences Melendez's ability to accumulate wealth. For example, a steady income and responsible debt management provide a solid foundation for saving and investing, leading to net worth growth. On the other hand, excessive debt or poor savings habits can strain Melendez's financial resources and hinder his progress towards wealth accumulation.

Real-life examples of financial health within John Melendez's net worth include his prudent investment decisions, which have yielded positive returns over time. Additionally, his ability to generate multiple streams of income, coupled with a disciplined savings plan, has contributed to his growing net worth. These examples underscore the practical significance of maintaining good financial health for building and preserving wealth.

Understanding the connection between financial health and net worth empowers individuals like John Melendez to take proactive steps towards securing their financial well-being. By prioritizing financial planning, managing debt effectively, and cultivating sound investment strategies, they can increase their net worth and achieve long-term financial success. This understanding extends beyond personal finance, highlighting its relevance for businesses and organizations seeking to optimize their financial performance and long-term sustainability.

In exploring John Melendez's net worth, this article has illuminated the intricate interplay between various financial components that shape an individual's overall wealth. Key insights include the significance of asset diversification, prudent debt management, and the generation of multiple income streams. Understanding these concepts is paramount for anyone seeking to enhance their financial well-being.

Ultimately, John Melendez's net worth serves as a testament to the power of sound financial decision-making and consistent effort. By understanding the principles that have guided his financial success, individuals can equip themselves with the knowledge and strategies necessary to achieve their own financial goals. Whether it's prioritizing saving, investing wisely, or managing debt effectively, the lessons learned from Melendez's journey can empower us all to build a stronger financial future.

Mason Cox: From Basketball To AFL Stardom | Biography, Age, Family

The Ultimate Guide To Qoves Studio Face Reveal Youtuber

How To Get A Clear Picture Of Chris's Financial Situation

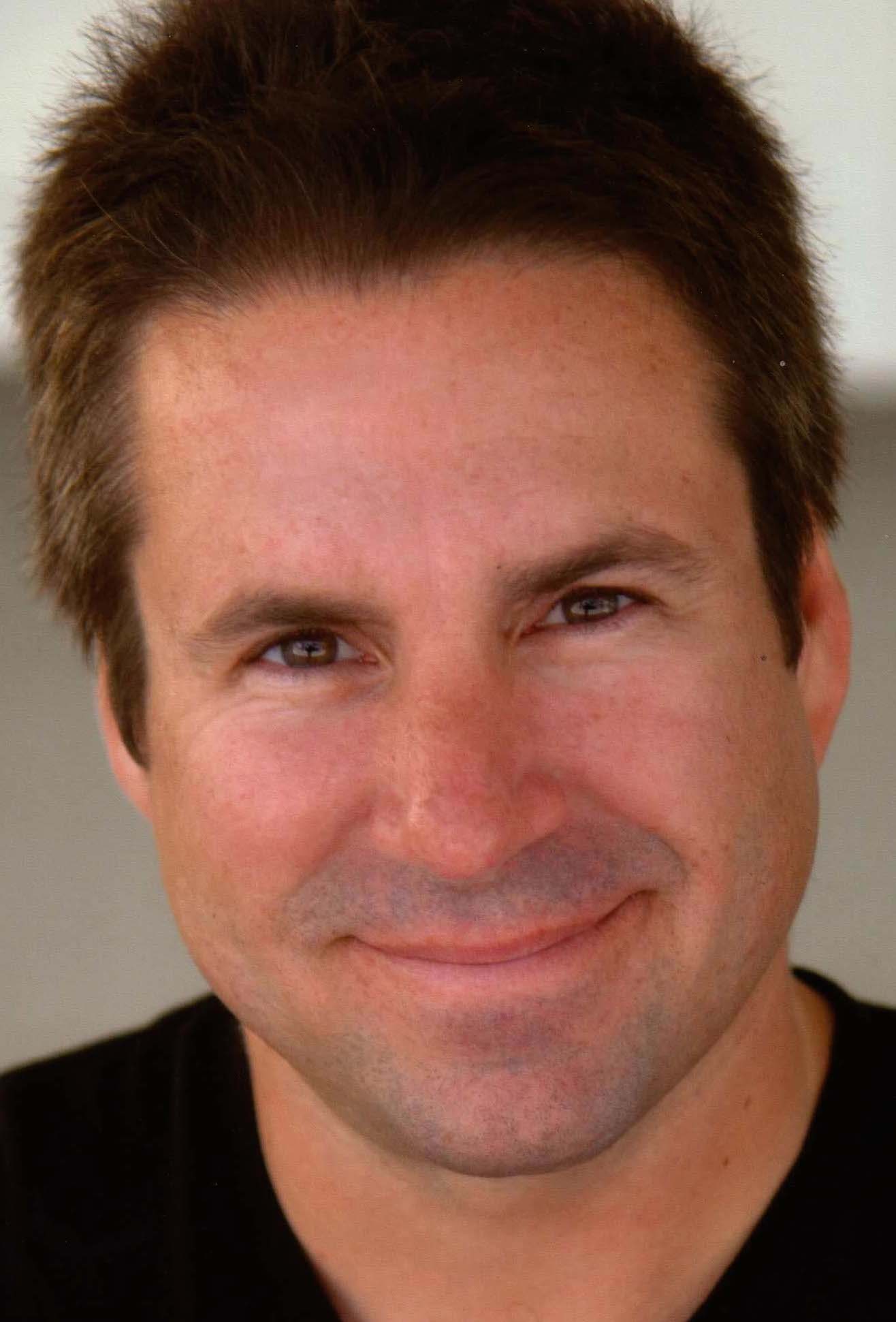

![John Melendez Net Worth Career & Lifestyle [2023 Update]](https://cdn.statically.io/img/i2.wp.com/wealthypeeps.com/wp-content/uploads/2022/08/John-Melendez-768x1173.jpg)

John Melendez Net Worth Career & Lifestyle [2023 Update]

» John Melendez/Stuttering John Las Vegas Backstage Talk

White House reviewing prank phone call incident Source

ncG1vNJzZmiclaHDr3rSbGWuq12ssrTAjGtlmqWRr7yvrdasZZynnWS3sLTNZqSepJWjsabGjKxkp52kYsSwvtOhZaGsnaE%3D